Transform your business to smart digital branches

Bridge the gap between your digital and physical channels- it's easy with SEDCO's technologies.

Your digital branch transformation starts here.

Accelerate Your Business Transformation Journey

Some customers prefer automated services. Others prefer the face-to-face experience.

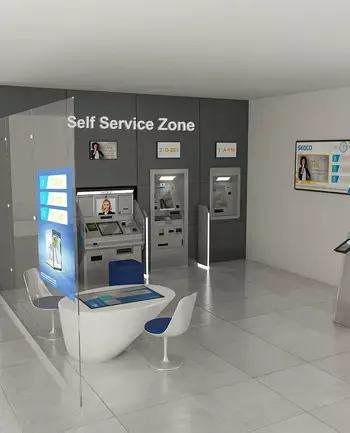

SEDCO bridges the gap between people and technology, with its digital branch transformation solutions, your customers can be guided to a service employee, a video agent, or to a self-service machine.

No matter what path your customers choose, the smart branch makes it easier to carry out your business transactions around the clock.

Whatever your business is, transform to digital branches

- Access to bank’s services 24/7 through self-service machines, such as printing new ATM cards, cheques book, bank statement and more.

- Less space and fewer costs required to operate at a wide scale.

- Customers can reach service agents via video call anytime, anywhere with virtual service machines.

- Run your branches with minimal staff, utilizing self-service machines to serve customers 24/7, such as SIM cards dispensing, top up, mobile balance, bill payment, mobile money, and more.

- Empower customers to buy physical items by themselves with self-service shops, such as mobile phones, tablets, and more.

- Customers can reach a remote agent via video call anytime, anywhere with virtual service machines.

- Quickly print medical reports, / prescriptions, and scan supporting medical documents with self-service kiosks.

- Customers can book their own medical appointments through the kiosks.

- Biometric scans allow customers to identify themselves.

- Streamline between walk-in and pre-booked patients.

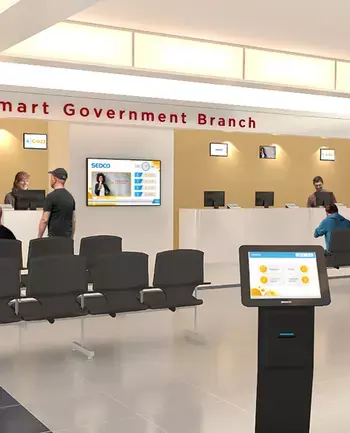

- Provide services to citizens and visitors 24/7, such as payment services, issuing work permits, verifying identity with biometric modules, capturing signatures, scanning, printing, and depositing supporting documents.

- Transform into a smart city by empowering citizens to get services anytime anywhere.

- Manage all premises centrally to improve service quality and deliver better citizen experiences.

- Enhance the customer experience, by providing 24/7 self-services including money exchange, remittance (funds transfer), and many other services.

- Reduce the cost of opening new branches.

- Expand your sales channel at a fraction of the cost.

- Maximize footfall and cross-selling opportunities.

- Reduce the waiting time, by redirecting some customers to the self-ordering kiosks to avoid waiting in long lines.

- Utilize your staff to the fullest and lower your labor costs.

- Decrease human interaction to maintain social distancing.

- Relocate the kiosks easily to branches with a higher footfall.

- Increase upselling, by displaying targeted messages on the kiosk screen based on the purchasing habits of your customers.

- Have better management and control of your restaurant and self-ordering machines with Business Intelligence tools.